5 Quick Money Tips for Millennials to Become Millionaires

I’m not a millennial because you have to be born between 1981 and 1996 (I was born in 1979). But I feel a little millennial’ish, and that makes part of me cringe when I read about them in the media.

Delusional. Lazy. Entitled.

The reality is 36% of you live with your parents, your unemployment rate is twice the national average, and if you happen to be one of the lucky employed, just 30% consider your job a career.

Sounds pretty bad, right? Yes, but you see, everyone who’s been a twentysomething doesn’t have their shit together yet. So it will get better. And the good news is I’m here to help you with part of this, and that’s how to manage your money.

Here’s what you need to know.

1. Your future self will want to retire

Right now, you’re not thinking decades ahead. But neither did most people your age who are now near retirement. Here’s some enlightening data about them.

- Only 20% of seniors have $10,000.

- A third of people near retirement age will live in poverty for the rest of their lives.

- Most families have saved $104,000 for retirement.

You have the unique opportunity to do much better than this. Here’s one simple way: Nearly 80% of full time workers have access to something called a “defined contribution plan.” And here in the US that usually means a company-sponsored 401(k) account.

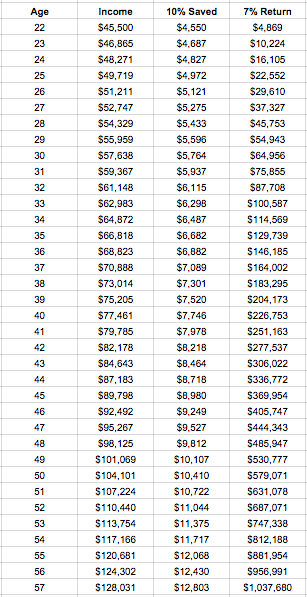

Now, assuming an annual market return of 7%, a 22 year old who starts out making $45,500 and gets a 3% annual raise can have $1 million at age 57 if they elect to invest 10% of their income. Let me show you what that looks like.

And at age 57 if you use the standard safe withdrawal rate of 4% you can generate an inflation-adjusted $40,000 a year in passive income from this. For the rest of your life. Not bad, right?

Key takeaway: At a minimum invest 10% of your income.

2. Don’t buy a house

The marketing propaganda from the real estate industry has always called a house an investment, and this is reflected in the fact that 65% of millennials think, “Buying a home is the best long-term investment a person can make.” But let’s take a closer look at that.

From 1890 to 2012 the inflation-adjusted return on a house was 0.17%. That means if you bought a house for $5,000 in 1890 it’d be worth $6,150 in 2012.

A gain of $1,150.

Over the same time period the inflation-adjusted return of the stock market was 6.27%. That means if you invested the same $5,000 it’d be worth $8 million.

That’s a gain of $7,995,000.

Do you still think a house is the best long-term investment?

Yes, you have to live somewhere. And nobody can live in a stock. But if you buy a house, live in it, and think it’s the best investment then you’re delusional. Now, I’m not against homeownership (I own a condo), but I am against anyone making the biggest financial decision in their life without first running the numbers.

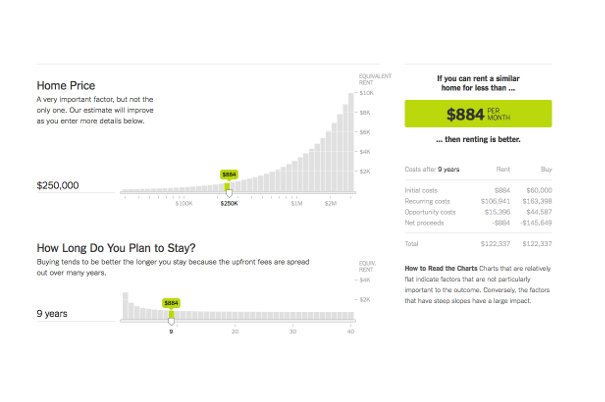

And you can start that process with this calculator.

While this tool does a good job of factoring in the total cost of ownership like insurance, maintenance, and taxes, keep in mind it doesn’t factor in soft costs. Stuff like the time you’ll spend researching problems with your appliances, fixing things that break, taking trips to the home improvement store, mowing the lawn, shoveling snow, and on and on.

Key takeaway: Run the numbers before buying a house.

3. Make investing an “and”

I’ve seen the same thing play out over and over again. It goes something like this.

People in their 20s: “I want to invest but I’m paying back student loans now.”

People in their 30s: “I want to invest but I have a mortgage and kids now.”

People in their 40s: “I want to invest but I’m putting my kids through college now.”

People in their 50s: “Shit, I have no retirement.”

If you make investing an “and” instead of a “but” you won’t end up old and broke. The big magic of investing really comes from this little thing called time. Here, let me show you.

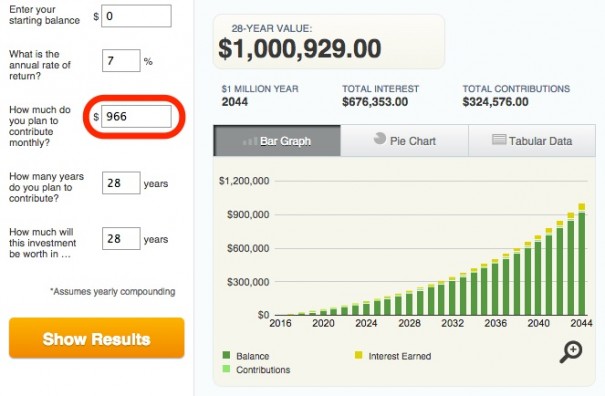

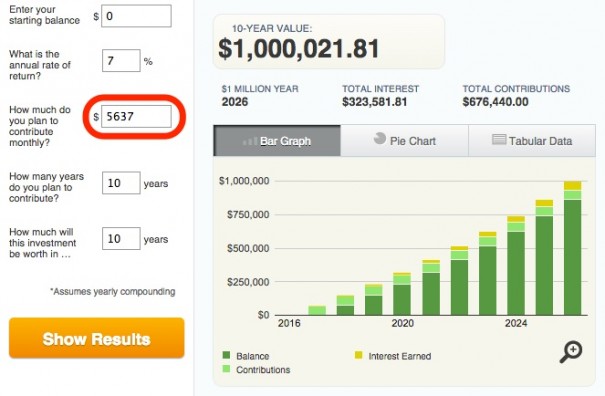

Let’s say you’re 22 right now and by 50 you want $1 million (inflation adjusted, too). To accomplish that, you need to save and invest $966 a month.

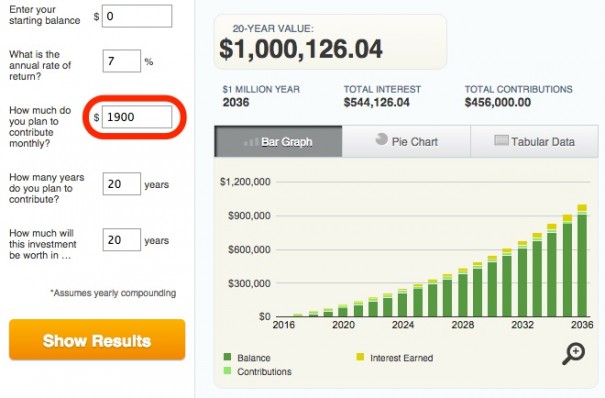

Now let’s say you’re 30 with the same $1 million goal. You need to save and invest $1,900 a month.

At 40? It’s $5,637 a month.

Key takeaway: Prioritize investing by making it an “and”.

4. Stop getting more degrees

Did you know our collective student loan debt is now over $1 trillion? And we keep going back to get more degrees. What the hell? And you might know someone like this.

“There aren’t any jobs for [inserts their degree here]. Lawyers get paid a lot, don’t they? Yeah, I think I’ll go to law school.”

And you know what happens next. They get the degree, and surprise, they can’t find a job.

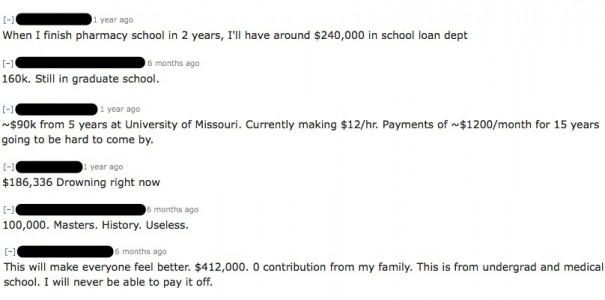

I get it. You might not have known exactly what career you wanted when you were in college (I didn’t). Or you might really need another degree to get the job you want. But before you commit, think strategically about your end game, otherwise you’ll end up like these people.

How do you think strategically? By figuring out how you can get the skills you need without a degree. Consider these options.

- There are free and inexpensive ways to learn anything online. Check out Code Academy, creativeLIVE, Khan Academy, Lynda.com, Skillshare, and Udemy.

- Some colleges have opened up their curriculums so anyone can take their classes for free. Scott Young got the equivalent of a computer science degree from MIT for $2,000.

- Volunteer. Intern. Job shadow. Show others you can be an independent learner that takes the initiative to gain the skills you need.

Google agrees with me on all this. They no longer require their employees to even have a degree. Why? Because they realized having one proves absolutely nothing about your ability to think critically and solve problems.

Key takeaway: Don’t assume you need another degree (and more debt) to do what you want.

5. Become wealthy not rich

Here’s an Audi R8 that retails for over $100,000.

On Quora, the guy who bought this car wrote about his experience. What he had to say was fascinating.

“Another piece of advice for anyone looking to get a supercar is to work your way up slowly, so you get more and more comfortable with the higher car payments. I went from an M3 to 911 now to V10 R8 in the last 2-3 years, and the 4-figure R8 payment isn’t hard to swallow since I have been used to making similar payments on the 911.”

Do you see what happened here? A BMW M3 used to be good enough, then it wasn’t. A Porsche 911 used to be good enough, then it wasn’t. Now an Audi R8 is good enough, until it isn’t.

Maybe this guy is rich. To pay for these cars he must be. But being rich isn’t the same thing as being wealthy. Most people think these are the same thing, but they’re not. Here, let me show you what I mean.

You can be “rich” if you make $250,000 a year, spend $250,000 a year, and have $0 in savings. In fact, 47% of Americans can’t come up with $400 for an emergency, and this includes a lot of “rich” people.

But you can be “wealthy” if you make $50,000 a year, spend $25,000, and have $500,000 in savings.

You see, it’s all about the relationship between your numbers. Choosing to be wealthy over being rich is what gives you freedom and control over your life, and as a millennial isn’t that what you really wanted all along?

Key takeaway: Being wealthy > being rich.