What You Need to Know About Investing to Become Wealthy

Some people spend their whole life living paycheck to paycheck. I know because they send me really sad emails about it. And now they’re in their 50s or 60s and realize they’ll have to work until they’re so old and sick that they just can’t work anymore. This is a shitty life so I want something better for you.

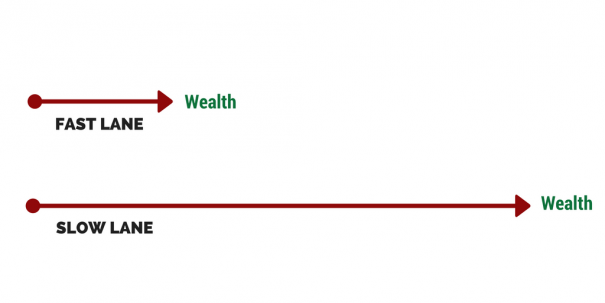

I just read The Millionaire Fastlane by MJ DeMarco. He talks about two ways to build wealth: The slow lane, and the fast lane. The slow lane is filled with all the people who save and invest. He’s not a fan of it.

Sure, saving money isn’t fun. And investing in boring index funds isn’t sexy. And it takes years, decades even, to build wealth this way. So MJ argues you can short circuit all this foolishness by getting in the fast lane meaning you pour your blood, sweat, and tears into creating a successful company and then cash out.

You should be in the fast lane, right? Well, I took the slow lane and was so successful at it that the New York Times published an article about me. So maybe I’m on to something by brutally cutting back spending and creating automated systems to save and invest.

Is accumulating wealth this way the medium lane?

One advantage I had was learning about the importance of investing at a young age. You see, when I was a kid my dad bought me a single share of Wrigley stock. (Perk: For Christmas they’d send me a free box of gum.) Every day I’d check the share price in the newspaper to see if I’d made any money. And I loved it!

I didn’t know anything about investing back then, but I realized owning stocks was a way to build wealth. And after talking with thousands of readers, most of them know this too, but they have no idea where to start. So here are the things you need to know.

1. Investing isn’t just for rich people

Here’s how investing works in farmer terms. (Hey, I live in Wisconsin and this is what people talk about.)

You buy a weak little colt for $500. It eats a lot of grass and over time grows into this big, beautiful, strong horse that’s now worth $2,500. On Saturday you walk your horse down to the horse market in town, and you sell it for $2,500. Boom, a $2,000 profit (and you didn’t even have to pay for the grass).

Investing is really that simple. And you can start with any amount of money.

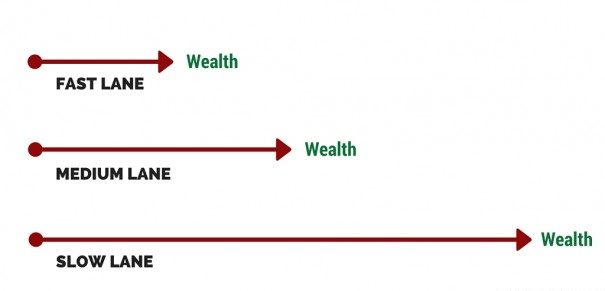

Now, you could’ve kept that $500 in your savings account. Over 50 years this is what $500 is worth (based on the 0.1% interest rate my bank pays):

Or, just like investing $500 in a colt, you can invest $500 in the stock market. Historically the market earns about 10%, so here’s how much $500 might be worth over 50 years:

Which one of these looks like the better option to build wealth? Right, investing.

2. Master the long game

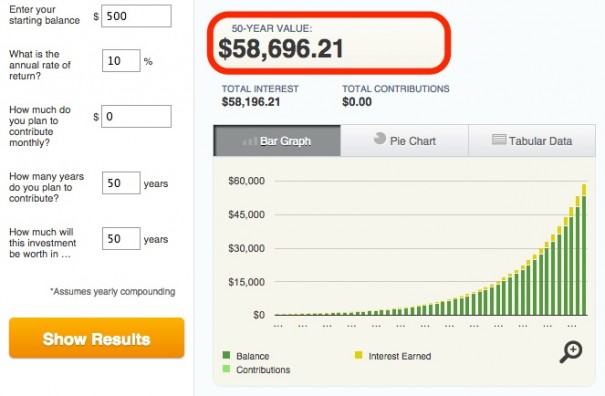

Here, I’m going to show you some pictures. And then there’ll be a test.

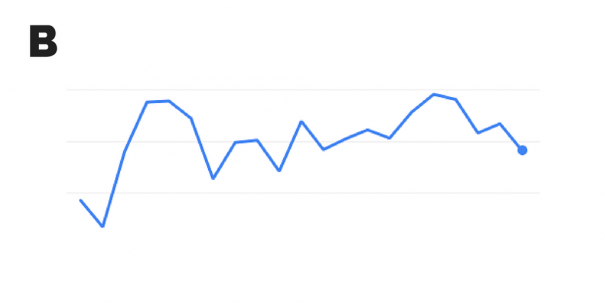

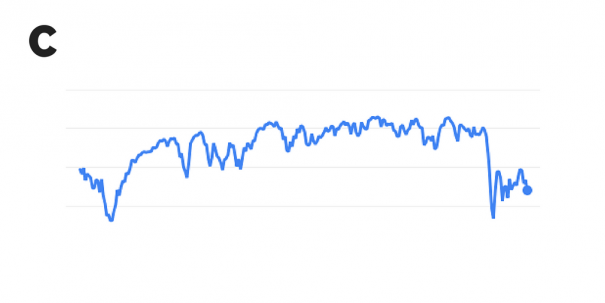

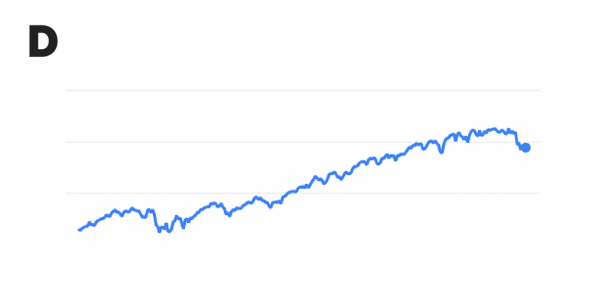

Can you guess what these are? Yes, it’s the stock market over different periods of time.

A = One week

B = One month

C = One year

D = Five years

Now scroll back and take a look at A again. Go ahead, I’ll wait.

If someone asked you to invest in A what would you say? You’d probably tell them to go to hell. But it’s important to understand that when you invest in A what you’re really investing in is D. And if you can withstand the short-term volatility of the market over weeks, months, and years, you’ll reap the long-term rewards.

3. Beat Wall Street’s fees

If your boss gave you a bonus you’d be happy, right? Of course. Unless you work on Wall Street because they get upset if their bonus is only $3.6 million. And most of this money is coming from fees, fees out of your pocket.

You’ve probably heard of investments like mutual funds, target date funds, or index funds. You might even own some of them. All of these funds have fees (also called the expense ratio), and if you’re smart you can save money by keeping them low.

Mutual funds are the worst because they rarely beat the market and usually have the highest fees (the industry average is 1.19%). Index funds, which match the returns of the market, average a lower 0.64%. And Vanguard’s index funds average just 0.14%. (Example: Their total market index fund VTSAX has a 0.05% fee).

These might all seem like insignificant numbers, so why does it even matter? It matters. Here, I’ll do some calculations to show you.

Let’s say you invest $10,000 and earn 7% over 50 years.

0% fee: $10,000 grows to $294,570

0.14% fee: $10,000 grows to $275,904 so you lose $18,666 to fees

0.64% fee: $10,000 grows to $218,231 so you lose $76,339 to fees

1.19% fee: $10,000 grows to $168,398 so you lose $126,173 to fees

By investing in low-cost index funds it means more money for you, less for Wall Street.

4. Adventures in taxes

In the U.S., investments are taxed one of three ways: Right now, sometime later, or twice. It all depends on what type of investment account you’re using.

Taxed right now: With a Roth IRA account, the money you invest is taxed with income tax, so when you start withdrawals at age 59 1/2 (or later), you won’t pay any additional taxes.

Taxed sometime later: With an account like a 401(k), the money you invest isn’t taxed, so when you start withdrawals you’ll pay taxes just like it was income.

Taxed twice: With a taxable account the money you invest is taxed with income tax, and then you’re required to pay capital gain taxes on any money you earn. (Example: If you invest $500 and it grows to $2,500, you’re required to pay taxes on the $2,000 gain.)

Why would you ever want this last option? A taxable account has always been a part of my investment strategy because I wanted access to the money before age 59 1/2.

5. Hacking inflation

People love to get really worked up about inflation. Here’s how I think about it.

The best savings accounts earn about 1%. These accounts are great to stash money for an emergency, or to save a downpayment for a house. The best CDs (which you can only get if you deposit like $50,000 for 5 years) usually earn just less than 3%.

With the inflation rate averaging roughly 3%, keeping money in a savings account or CD are both bad for building wealth because they don’t even keep up with inflation.

The stock market historically returns 10%, so by investing you can beat inflation by 7%. (Hint: use a 7% interest rate for all your investment planning, it keeps everything in today’s dollars.)

6. Going from $0 to $1 million

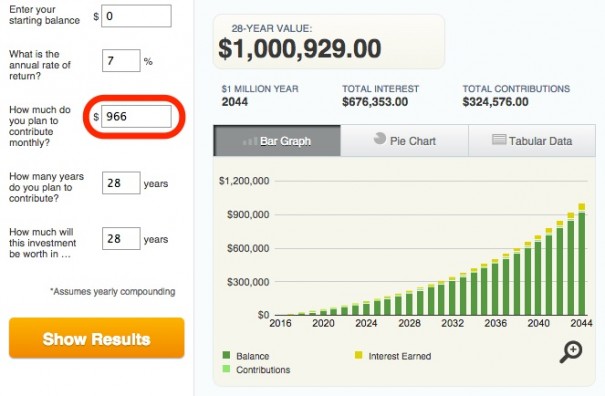

I want to show you something. Let’s say you’re 22 right now, and by age 50 you want $1 million, in today’s dollars. To accomplish this goal, you need to save and invest just $966 a month. (And think about what happens when you increase that amount as you progress in your career.)

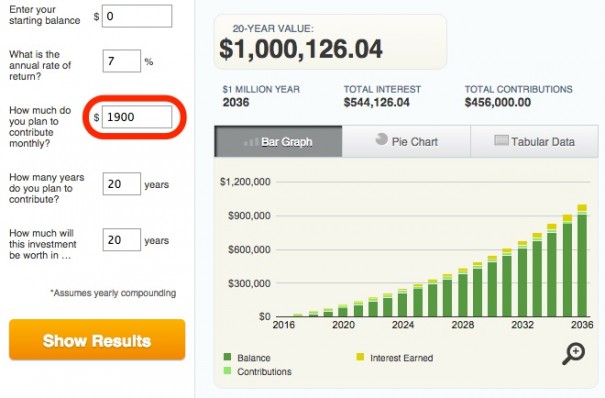

Now let’s say you’re 30 with the same $1 million goal. You need to save and invest $1,900 a month.

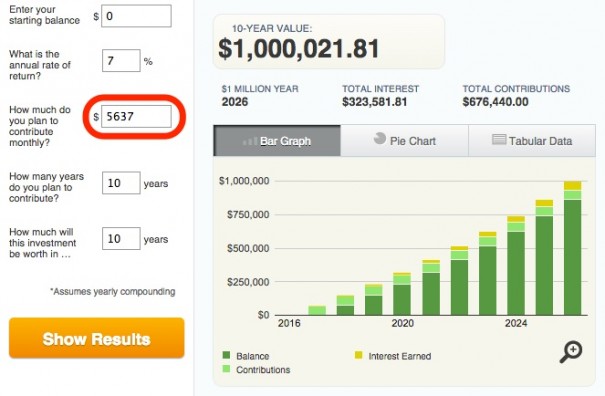

What about at 40? It’s now a staggering $5,637 a month.

The key takeaway from all this? If you really want to build wealth, you need to start investing right now. Because the longer you put it off the harder it becomes. Are you with me on all this? Ok, good. Now go invest.