Here Is the Ultimate Method to Reverse Lifestyle Inflation and Regain Control of Your Money

Working at my first job out of college I didn’t have any money, and I didn’t know how to cook. So every day for lunch I’d bring cheap microwavable dinners – linguini with clams – and eat in the break room.

But as my career progressed and I made more money I started going out for lunch. Every day I’d drive 15 miles round trip to eat from a table covered with white paper. And pay $12 to do it.

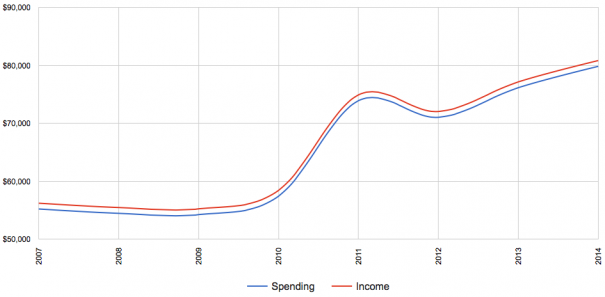

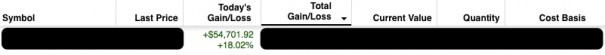

That’s what I’d call lifestyle inflation. It’s when your spending goes up as your income goes up. I can show you what it looks like in this graph:

Most people fall victim to this. And if you do it your whole life then get ready to work until you’re so old or sick that you can’t physically work anymore. It’s one reason why it’s so important to track your finances, because it lifestyle inflation creeps in unconsciously without you even realizing it.

Let’s say you get a $10,000 raise. You might decide you deserve to drive a nicer car, buy that more expensive bottle of wine, or move to a place with granite countertops. Soon your raise disappears, and you’re back complaining to your boss that you need another one.

It’s why NBA players who take pay cuts to $6.4 million say it’s going to be hard on their family.

During the summer of 2010 at 31 years old I quit lifestyle inflation. Because I was at work and realized there were people 25 years older than me still doing the nine-to-five grind. I thought, “What kind of life is that? I can’t do that to my future self.”

I needed to tip the scale so I was in control of my life, not some job. And I started doing research, googling things like “financial freedom” and “early retirement,” and the book Your Money or Your Life kept coming up. I read it, and it changed my life.

The old Chris worked to earn and earned to consume. And my new approach was to work to earn, earn to save, and save to invest, so I could stop working. That’s freedom.

It sounds simple, but where do you start?

1. Implement the 80-20 rule

Most people have heard of the “Pareto Principle,” also known as the 80-20 rule. The idea, introduced by Vilfredo Pareto in the 1790s, is that 20 percent of your efforts produce 80 percent of the results.

If you apply that to your finances, you can make a massive impact undoing lifestyle inflation by focusing on just a few big areas. Where you spend the most money (again, you’re tracking that, right?) is probably similar to the average American household: Housing and utilities ($16,895), transportation ($7,658), and food ($6,372). So target changes in those areas first.

Housing

Renting is better than buying, even though most people don’t believe it. If you’re going to buy, then at least buy less house.

In the 1950s, the average house in the U.S. was 983 square feet – now it’s 2,453! Bigger is not better when it comes to housing, as more house means more money to heat and cool, more money towards property taxes, more money towards maintenance and repairs, and maybe most importantly, more loans.

Location matters too, so think like a cat when it comes to picking where to live. No one had any idea where cats went until researchers put GPS on them. They found most cats stay within 200 feet of their home. Everything they need is right there. For you, that means living close to your job and urban amenities.

Transportation

Smart millionaires drive 10-year-old cars, because they don’t care what people think of them. Or, they don’t even own a car because they strategically picked where to live and can use public transportation or their legs to get around.

If you need to own a car, at least drive a 3-year-old+ and fuel efficient one. I like the jack-of-all trades Honda Fit, or the more sporty Mazda 3 Hatchback. Do preventative maintenance to mitigate the risk of costly repairs, negotiate your car insurance, and if you’re in a two-car household, think how you could downsize to one.

2. Tactics to control everyday spending

After you focus on the big wins, you might need to get control over those everyday dollars that leak from your bank account. Here are five tactics I use to help me out.

Pay yourself first

Paying yourself first means you get paid before anyone else. Do that by setting up a monthly transfer of money that goes into a separate savings or investment account.

I helped a reader do just that after they emailed me:

They make $2,000 a month and spend about $500, so I had them create a monthly transfer of $1,250 that goes directly into their investment account. What’s left over is used to pay bills and spent guilt-free.

Pro tip: Whenever you get a raise, adjust the transfer to reflect your new salary.

The 30-day waitlist

Research shows wanting things makes us happier than actually buying them. One of my favorite strategies is to install Amazon’s Wishlist browser plug-in, and instead of mindlessly buying things you may not need, add them to your Wishlist.

Then wait 30 days. After that, reevaluate if you still want it. No? Delete it from your Wishlist.

What I like about the plug-in is you can add items from Amazon and anywhere else on the internet. I use this method to maintain my 40-piece capsule wardrobe.

Create awareness

The Everyday Dollar Diaries is a popular series where readers keep a daily spending journal for one week, and I publish the results anonymously. The point of the exercise is to bring an awareness to how we all spend our money.

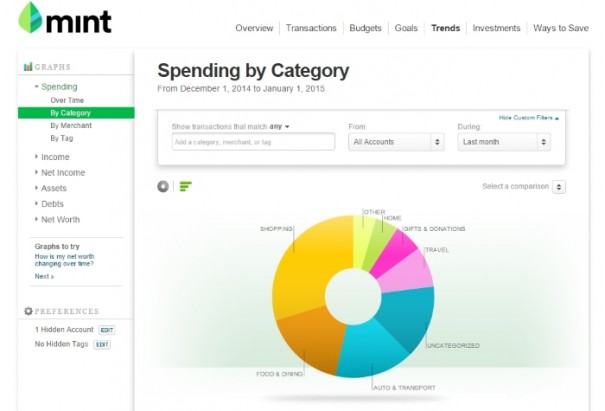

Make it a habit to track what you spend—either through a diary or a tool like Mint or YNAB. You can use the information to help change your behavior so you’re spending money in alignment with your goals.

Do the math

As I mentioned earlier, if people did the math they’d figure out that buying a house isn’t the best financial decision. While doing the math is so important for big stuff – like buying a house – it’s equally important for smaller stuff too.

My morning routine is the same every day. I brew coffee, make a smoothie, and pop a multi-vitamin. I was running low on vitamins recently so I logged on to Amazon to buy more and found this:

Uhh, what’s the cheapest option per tablet? I did the math to figure it out: The “150 (2-Pack).”

It’s important to note we shouldn’t make decisions solely on math, but it’s one aspect we need to weigh among others when we make decisions.

Pay up when it matters

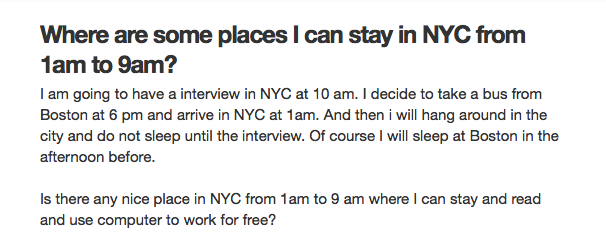

Do the math, but don’t be this guy:

Do you think he’ll get the job? Sometimes, not skimping makes sense. Like flying business class if it means you can sleep six hours, land, and get to a job interview refreshed and on top of your game.

And this is one I still struggle with, but I’m getting better.

3. Shift your mindset

Scientific evidence shows that taking action changes your mindset. Like if you put a pencil between your teeth to force a smile, you’ll become happier. Or if you stand with your legs apart, you’ll gain confidence. First we change our actions, then we can change our mindset.

Here’s a picture of an Audi R8. It retails for $116,000.

The owner of this car wrote about his experience buying it. It’s fascinating because he perfectly describes lifestyle inflation.

“Another piece of advice for anyone looking to get a supercar is to work your way up slowly, so you get more and more comfortable with the higher car payments. I went from an M3 to 911 now to V10 R8 in the last 2-3 years, and the 4-figure R8 payment isn’t hard to swallow since I have been used to making similar payments on the 911.”

See that? Similar to how I worked up to going out for lunch every day, lifestyle inflation becomes the new normal.

I could walk into an Audi dealership today with a metal briefcase full of cash – that’d would be awesome – and buy an R8. But I can’t justify paying $116,000 for a car, because it’s a piece of metal that gets me from point A to point B. My 10-year-old BMW can do that, but I saved $100,000.

Here’s the mindset shift part: Based on a four percent safe withdrawal rate, the $100,000 I saved earns me an inflation-adjusted $4,000 every year for the rest of my life. That means I don’t have to spend my time working to make $4,000 because my money is out there earning for me.

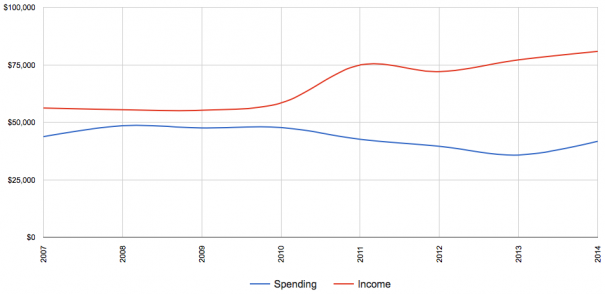

And sometimes in a single day my portfolio earns me more than enough to live for a year:

That’s the freedom I was after. When you look at every decision you make and align them to your financial goals you’ll build real wealth over the long term. And this puts you in control of your life not some job or anything else outside your control.

Final note

People spend $132,000 to take an around-the-world trip, $179 million to hang a Picasso on their wall, and in one of my favorite Reddit threads of all time, waste money on all kinds of weird stuff:

- Wearing a new pair of socks every day

- $150 a month watering the lawn

- $200 a month on Lego bricks

Everything you do, including how you spend money, comes with an opportunity cost. That means you take away from something else, whether directly or indirectly. Like when people say, “There’s no such thing as a free lunch.” That means you gain the value of the lunch, but lose an hour of your time.

For fun, I used to spend $1,000 a month flying airplanes. I liked to be able to tell girls at the bar I was a pilot. (Eventually I discovered the ones who cared weren’t the ones I should be dating.) But at the time, I didn’t understand the opportunity cost of my hobby. As I reversed my lifestyle inflation and began aligning my decisions with my goal of freedom I quit flying.

Spending is all about balancing opportunity costs. And it will be different for everyone based on what you value. It takes time to master, but once it becomes automatic, freedom will be yours.