A System for Automating Your Personal Finances

Are you one of the people that get a paper paycheck, even though your employer offers direct deposit? Or maybe you get bills sent to you in the mail requiring you to keep track of due dates, write a check out, dig through the junk drawer to find a stamp, and then drop the payment in the outgoing mail, even though you could be receiving paperless statements and automatic bill payment?

In the past, and we’re talking the 1990’s, most of us were wasting hours of our lives handling our personal finances, because there wasn’t a better option. But now that the internet has revolutionized our lives, we have the opportunity to unleash it on our finances, saving us time, saving us money and perhaps best of all, simplifying our lives.

Here’s the 3 reasons to automate your finances:

- You’re wasting your time. Transferring money between accounts, finding bills, paying bills, filing statements, and driving to the bank to deposit paychecks all steal precious time from our everyday lives. By freeing up more time, we can to focus on the big wins like our career, our education and skills, or a side business.

- You’re wasting your money. Not handling personal finances automatically and electronically, we open ourselves up to late payment penalties, fees, and other service charges.

- Simplify your life. Less tasks to perform in our already busy lives lowers our stress and decreases clutter.

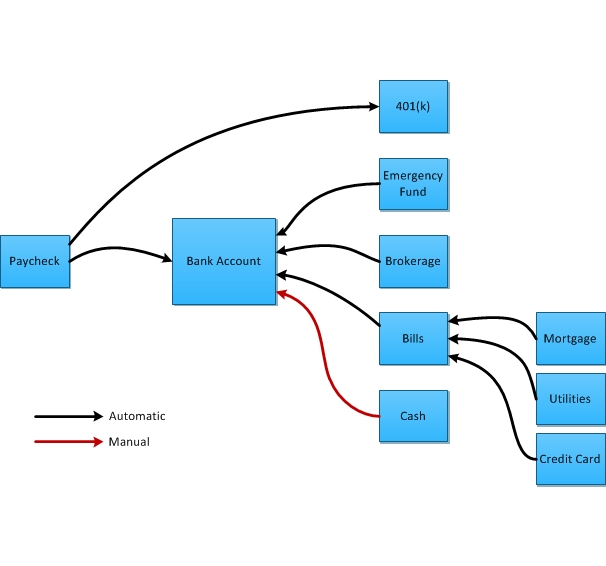

I want to share with you a system I developed that will assist you in automating your finances. I guarantee if you spend the upfront time setting this up now, you will get payback in time and money!

1. Bank account

The most important component of this system, the bank account is where all the action comes from. Your income automatically ends up here and your expenses are automatically withdrawn from here. I like to recommend using a local bank or credit union for this account. If you’re not already, be sure to enroll for paperless electronic statements!

2. Paycheck

If your company offers it, which most do, have your paycheck direct deposited into your bank account. Request that you receive a paperless pay statement.

3. 401(k)

A percentage of your paycheck should be automatically transferred to your retirement savings account, such as a 401(k). I recommend if your employer offers a matching contribution, do not leave money on the table and contribute up to the company match (at a minimum).

4. Emergency fund

No one likes to have an emergency fund, until you have an emergency! Establishing an emergency fund will help you when there’s a job loss, medical issue, or an unexpected home or car repair.

I recommend you put aside three to six months of your expenses. In order to build this account I like to recommend a separate bank account – either an online one like Capital One 360 or a completely separate account at your bank – so it’s not easy or tempting to dip into.

From your emergency fund account, configure a set amount of money to be withdrawn from your bank account until you have reached your target emergency fund amount. Configure this withdrawal to recur on the first of every month.

5. Brokerage account

If you don’t have any short-term debt, are saving an adequate amount for retirement, and have an adequate emergency fund, then consider committing part of your income to a brokerage account. This money can be used to invest in additional retirement accounts like a traditional or Roth IRA. Or perhaps you want to invest in the stock market.

Transferring money to your brokerage account is easily automated. From within your brokerage account, have a certain amount of money withdrawn from your bank account via ACH and placed in your brokerage account. Configure this withdrawal to recur on the first of every month.

If you’re not already, be sure to enroll for paperless electronic statements!

6. Bills

The area where most of us can improve is bills. First, where you can, set up every bill to be automatically charged to your credit card. You should be able to set this up for most monthly services such as cell phones, cable subscriptions, and Netflix. By compressing multiple bills down into one credit card bill we’re simplifying our lives. And hopefully you’re earning credit card rewards too, which is nice.

For bills that cannot be paid for with a credit card, maybe things like mortgage/rent or utilities, set these up to automatically be withdrawn from your bank account via ACH.

At this point, all bills are being paid electronically. Be sure that you’ve requested paperless electronic statements for all your bills as well.

7. Cash

More and more of us only carry plastic and shun the places that only accept cash. While I generally like the convenience of plastic, at some point we need cash.

If you deploy my system for automating your personal finances, hitting up the ATM will be the only manual part.

I like to withdraw a set amount of cash per week, $100, in order to pay for things like eating out, groceries, and beers with the guys. I recommend this approach because it helps me regulate my spending. If I run out of my $100 before the end of the week, I’m know I’m eating rice and beans and drinking box wine until next week.