3 Tools to Track Your Spending Now

In the Everyday Dollar Diaries series, real people wrote down what they spent over the course of a week, and then I published the results anonymously. It’s been really popular, because all of us want to take a peek at how others spend.

But the purpose of the series isn’t to be a passive voyeur, it’s to challenge yourself to keep your own diary for one week, because knowing what’s happening with your money is the first step to get control over your finances.

Many of you will immediately see the benefits, and will want to continue the practice by tracking your spending long-term. At this point I’m supposed to tell you an ugly, complicated budget spreadsheet is the answer.

But I never used a budget because I didn’t think they worked. If we’re being brutally honest here, you might fill one out, desperate to gain control over your finances, but it’s a short-lived habit. You find as soon as you fill it out, you’re already over budget, or an unexpected expense throws the whole thing off. It’s human nature – we start with the best of intentions, jump in enthusiastically, and then struggle to build the habit.

Years ago I got hooked on hot yoga. I practice it twice a week, because I feel it makes me a better person, both physically and mentally. Every January, the people who made a resolution to do yoga pile into the classes, and that means I have strangers sweating on my yoga mat, which is not okay. Come February most of them lose interest and give up. A budget is no different.

Recently though, I got an email from a reader who told me by implementing a budget, she went from living paycheck-to-paycheck, feeling scared and helpless, to finally becoming confident with her finances, at 61-years-old. She could now pay her bills effortlessly, put money away, and even had extra she could spend guilt-free. It was life-changing.

So instead of being completely dismissive of budgets, her story convinced me to take another look. I spent some time testing tools that can both track spending, and create a budget. If you’re not using a tool today, then your job is to pick one. Don’t get hung up making the decision, just go with the one you think will work the best for you.

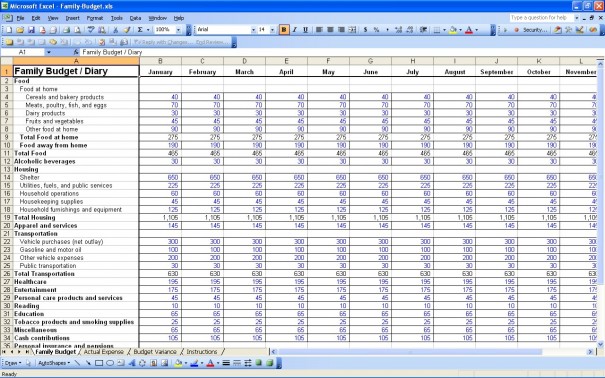

1. A notebook or spreadsheet

What does it do?

Whatever you want it to! A notebook and a pen, or a spreadsheet for the tech-savvy, is a simple way to track spending. Keep a notebook – my favorite are these – and a pen with you at all times, or create a Google Doc spreadsheet, which can be easily accessed from a browser or smartphone. Each time you spend money you can write it down, even creating a running ledger by adding in your income, like I did above.

Who is it good for?

If you’re looking for a quick way to get started, this is it. The main reason I like this tool is it heightens spending awareness, because you need to put pen to paper, or hands to keyboard, every time you spend. It’s also good for those that like to tinker, because you can customize however you see fit.

The downside is two-fold. First, you need to have discipline to record each time you spend. Second, if you’ve compiled a few months of spending data, you might want to use that information to set parameters around your spending, or create a budget. That’s great, but you’ll need to create those, and make sure you follow them.

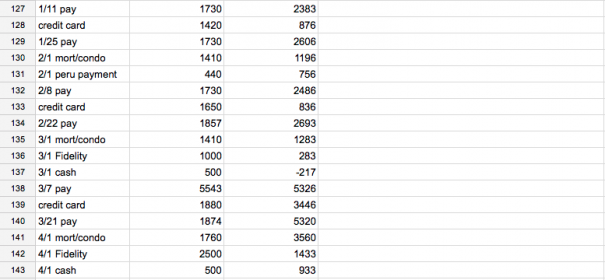

2. Mint

What does it do?

Mint is a free online service – accessible from a browser or smartphone app – that aggregates all your accounts: bank, brokerage, credit card, loan, and retirement. It automatically downloads and categorizes your spending, but be prepared to tweak entries when they get mis-categorized. With your spending data in-hand, you can create budgets based on that information, and set up savings goals for things like a vacation, or down payment for a house.

Who is it good for?

If you have a handful of financial accounts, and you’re busy, this is an efficient option. The main reason I like this tool is the automatic sync and categorization of your spending, and the visual representation of the spending data.

However, that same automation is the downside of this tool. The hands-off approach to tracking your spending is great, at a cost of losing awareness. And if you decide to use that information to create budgets and goals, you need to have the discipline to stay on target, because the tool doesn’t care if you don’t.

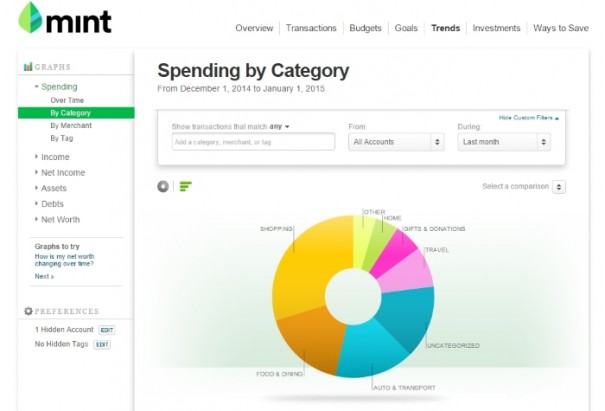

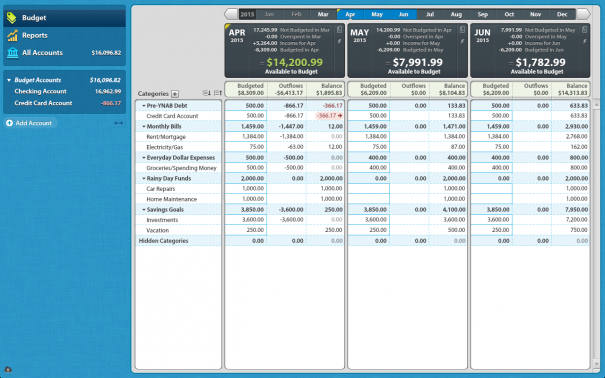

3. YNAB (You need a budget)

What does it do?

YNAB is a paid budget application that runs on Mac or PC, and comes with a smartphone app that syncs back to the application (which requires a free Dropbox account). Your spending can be entered manually, or if you download a special file from your financial institutions you can automatically import it. The application is budget-focused, and forces you to give every dollar a job.

You can try it free for 34 days, then are required to purchase a one-time license for $60.

Who is it good for?

If you’re having a tough time getting out of debt, controlling your spending, or trying to save money, this is the hardcore solution for you.

The main reason I like this tool is it’s the perfect love child of the other tools. You get the awareness of tracking your spending with a notebook and pen, and you get the technology and slick graphs of Mint. On top of that solid foundation, YNAB adds proactive budgeting – each dollar earned is allocated to an upcoming expense, so you gain control over your finances. (This is the tool the aforementioned reader used to transform her life.)

The downside of this tool is the learning curve, and upfront time commitment, but both will eventually level off as you find yourself in maintenance mode.

Why you need to track your spending now

Today, if you kinda-sorta know what’s happening with your money, my challenge to you is to pick one of the three tools right now, and set a goal to use it for one month, because I want you to create the habit of tracking your spending.

It’s kind of like when I was in recovery. We used to talk about how getting all our addictions under control was similar to eating an elephant. I think that describes the struggle many of us have with our money – we just don’t know where to start. But by tracking your spending first, getting control over your finances doesn’t become so insurmountable, the same way eating an elephant is accomplished one bite at a time.