3 Reasons Not To Invest In An Index Fund

I’m always amazed at how many personal finance blogs recommend investing in index funds. There was a recent post at Money Q&A where Hank asked 12 personal finance bloggers where they would recommend an investor put $1,000.

Out of the 12 bloggers one said individual stocks and the rest effectively said an index or mutual fund.

Yes, I think an index fund is better than stuffing money under your mattress, or having inflation eat away at it in a savings account, but a lot of people are missing out on the chance to build real wealth.

Until 2006 I was an index investor. I only had a few thousand dollars back then, and what I always read was to invest in index funds, so that’s what I did.

There are certain benefits to investing in an index fund. First, the fees are close to nothing because there’s no management to do.

For example, when you buy an S&P 5oo index fund — which consists of the top 500 publicly traded companies in the U.S. — I’m pretty sure a computer does all the work.

Second, there’s no work to do for the investor. You can rest assured you will own the top 500 stocks, period. Considering these two factors, for someone brand new to investing it’s a decent way to dip your toe in the water.

Before I delve into why I think investing in individual stocks is a much, much better way to build wealth, I want to say that with investing there’s no black and white.

But if you have the time, the curiosity, and the patience you can succeed, and beat index funds.

I realized a while back there were three ways to reach my goal of financial independence: start a successful company, inherit a large sum, or invest. I’ve never been interested in starting a company, and as far as I know I’ll never receive any inheritance. So, yeah, investing.

1. You get the lousy with the great

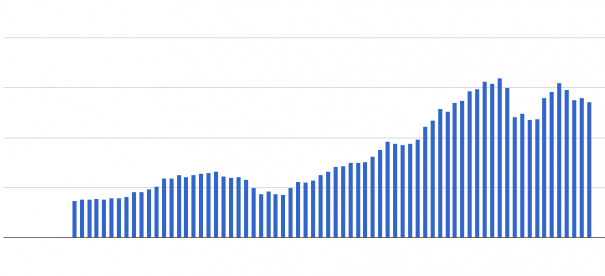

You don’t want to put money into an index fund that represents a cross-section of U.S. businesses: some good, some average, some lousy. You want to find and buy shares in great companies with the potential to compound their earnings year after year. Patient shareholders, like myself, have witnessed this firsthand. And let me tell you it’s pretty cool. There’s been rough patches, times I’ve seen my portfolio take huge hits, and here’s a chart to prove it:

But I maintain my bullishness on stock investing over the long term. As you can see, even though I’ve had some of my businesses go through tough times, my portfolio is always trending up. Not all of my stocks will crush the S&P 500 — the benchmark I use — but I think the majority will.

2. Diversification, as you know it, is not good

I believe in diversification. But I believe in it across time, various economic conditions, and by buying shares at better multiples. I mainly invest in tech and restaurant and retail stocks because they are easy to understand for me.

As I study them over time I become more familiar with them. I can see what factors affect their share price, and what factors affect their earnings. Why their guidance changes. How many stores they are going to be able to build to know where they are in their growth cycle. You begin to see patterns.

With this knowledge I am able to exploit the short term traders, selling on the news or after a weak quarter. I am a long-term investor so I don’t look short term. I take the long view, and that means five years to a decade.

A new investor may think that diversifying across industries will protect them from ignorance, and that’s a great point! For example, if the retail sector falters because of high oil prices, by being invested in the energy sector it will act as a counterbalance. High oil prices means energy stocks will be higher.

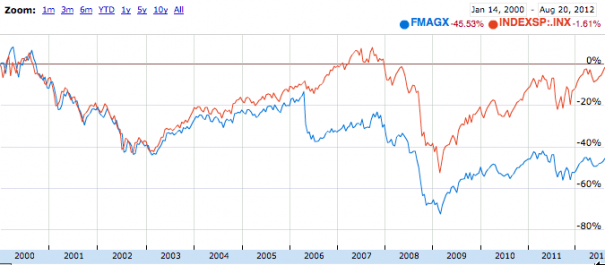

You can get instant diversification with an index fund. But since 2000 funds haven’t really done that well. The Fidelity Magellan flagship fund (FMAGX) has underperformed the S&P 500 in that time:

And the S&P 500 has had dismal returns as well:

I always thought that the mutual fund companies preached diversifying with funds as a strategy to promote what they were selling. I think you can do just fine with a portfolio of 10 to 20 individual stocks and really crush the S&P 500.

3. Sacrificing returns for perceived safety

Many investors never leave index funds because it’s safe. But I think they take this too far. Randomly picking a few companies from various industries is no good either, frankly it’s downright dangerous.

Tech and restaurant and retail is very easy to understand and invest in, that’s why I like them. They are predictable and their prospects are very visible. You do not have to have a lot of stock market skills to do well if you stick to easily understood industries like restaurants and you can value them based on the Price to Earnings (P/E) multiple.

I have no idea how to value a bio-tech company or a semiconductor manufacturer so I will never invest in one. But a restaurant, that’s easy. The bulk of my portfolio is invested in these companies: Apple, Amazon, Chipotle, Coach, Google, Lululemon, Netflix, Priceline, Panera, Starbucks and Whole Foods.

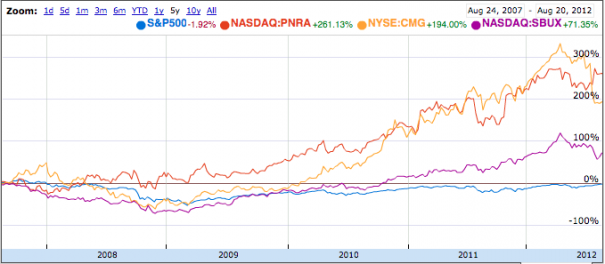

Let’s check out the performance of shares in the restaurants I own versus the S&P over the last 5 years:

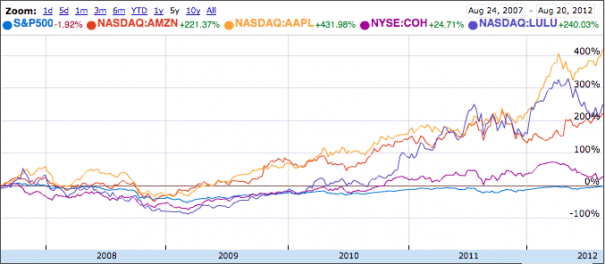

The retail stocks over the last 5 years:

And finally the tech companies over the last 5 years:

All these companies are easy to understand. They have great leaders at the helm. They have visible growth prospects. They are killing the S&P 500, and are positioned to beat the S&P 500 in the long haul.

With all that said, I hope you think about if index funds are the right fit for you. For some, they will be and that’s perfectly fine. You can shovel cash into them and effectively outsource the management of your investing. Your portfolio will grow.

But, if you have an interest in stocks and want the opportunity to crush the market over decades, I suggest investing in individual stocks. While it can be a little scary going it alone, think about signing up for a service like Motley Fool Stock Advisor where they offer stock suggestions and have forums for discussion. This is a really great path for new investors.

Additionally, before you buy your first stock read investing books. A good first one is One Up On Wall Street by Peter Lynch.

I think one of the reasons I have had a good experience investing in individual stocks is that I am genuinely interested in investing. It takes time to learn, and I will be learning about investing for the rest of my life, but I truly enjoy it.