How should I invest a lump sum?

Today’s question comes from Daniel. He asks:

“I have $50,000 to invest. Should I put all of it into the market at once?”

If you’re like most people $50,000 is a huge windfall so you don’t want to mess up and lose any of it. In fact, this is something researchers call loss aversion. It means we feel the pain of loss much more than we feel the pleasure of gain.

And the studies on loss aversion are fascinating. One of them, from Daniel Kahneman and Amos Tversky, demonstrate how we react through a simple coin toss. Kahneman said this is the typical response he gets:

“In my classes, I say: ‘I’m going to toss a coin, and if it’s tails, you lose $10. How much would you have to gain on winning in order for this gamble to be acceptable to you?’

People want more than $20 before it is acceptable. And now I’ve been doing the same thing with executives or very rich people, asking about tossing a coin and losing $10,000 if it’s tails. And they want $20,000 before they’ll take the gamble.”

In other words, we like gains, but we hate losses even more. And that’s why when you have a lump sum to invest I like to use this rule of thumb: Invest at 1X to 2X the rate at which you can save money. Here, let me show you an example of this.

Pretend you make $48,000 a year, which is $4,000 a month. You spend $3,000 so you’re able to save $1,000 a month. If you have a $50,000 lump sum you’d invest it at a rate of $1,000-$2,000 a month.

Now, $50,000 invested at a rate of $2,000 a month will take 25 months to invest. Yes, two years. Why would you have money just sitting on the sidelines when it’s ready to go out and start working for you?

For a couple reasons. First, to protect you from yourself. I’ve seen people invest a lump sum all at once and then the market crashes and because we hate losses they sell everything and swear they’ll never invest again.

To me this is unfortunate because investing really is the best way to build wealth. So by easing smaller amounts of money into the market over longer periods of time it gives new investors more time to get comfortable with investing.

Second, you’re reducing risk. You see, if you invest a lump sum all at once you don’t know if you’re investing at the top of the market or the bottom. And you won’t know until weeks, months, even years go by.

So by spreading your investments out you build an average. Let me show you what I mean. Say you’re investing $2,000 on the first of each month. Because share prices fluctuate the number of shares you can buy will be different each time.

Month 1: $2,000 @ $20/share = 100 shares

Month 2: $2,000 @ $16/share = 125 shares

Month 3: $2,000 @ $25/share = 80 shares

Month 4: $2,000 @ $40/share = 50 shares

Month 5: $2,000 @ $25/share = 80 shares

Month 6: $2,000 @ $20/share = 100 shares

And so on…

Some months your $2,000 buys more shares, some months less. Overall, you buy 535 shares at an average price of $22.43.

What if you had invested your lump sum all at once when shares were at their lowest price of $16? This would have been optimal. But of course you can only know this in hindsight.

And what if you had invested your lump sum at the highest price of $40? You’d regret it.

By investing a static amount each month you average everything out. (Btw, this is called dollar cost averaging.)

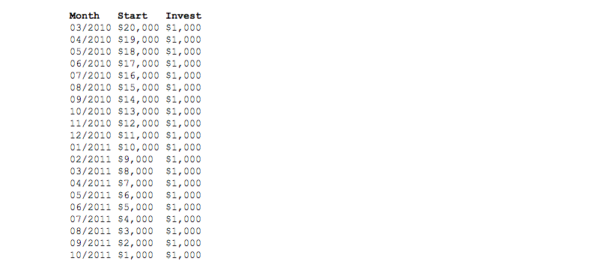

This is what I did when I had a lump sum. I had saved up $20,000 for something. I think it was when I wanted to buy 5-10 acres of land out in the country and put up a yurt so I’d have a weekend getaway.

Anyways, I had this lump sum, and I typed up a simple plan in a Google Doc to invest $1,000 each month until it was 100% invested. Here it is (I knew it’d come in handy some day).

You can invest a lump sum all at once. In fact, you might even get slightly better gains. But you also have to be okay not knowing if the market is going to crash, and if it does do you really know how you’re going to react to it? Most of us don’t, and that’s why I think you shouldn’t invest a lump sum all at once.