An Experiment Generating Passive Income with Real Estate

People are always asking me if real estate or stocks are a “better” investment.

If you only look at returns you’ll discover stocks crush real estate. But people don’t always invest for returns, they might invest for monthly cash flow, a big reason to invest in real estate.

But when I think about real estate I imagine driving around town collecting rent checks, getting calls about leaky faucets, needing to replace ancient furnaces.

Plus, you can’t buy and sell real estate with the click of a mouse button. With stocks all you need is a laptop and internet connection to make money.

Then I started hearing about crowdfunding real estate.

It was President Obama who signed the JOBS Act into law in 2012 allowing companies to acquire funding through online portals. It’s why sites like GoFundMe, KickStarter, and Kiva exist today.

I didn’t know crowdfunding crossed over into real estate until a reader started emailing me about them. And around this time I was attending Fincon — a personal finance conference — and met a guy obsessed with these sites.

So after getting back home I decided to try a little $1,000 experiment.

I quickly learned there are a gazillion sites, and so I called Craig and told him to tell me everything he knew about real estate crowdfunding.

The top sites are Fundrise, PeerStreet, and RealtyShares, but they have key differences.

First of all, Fundrise offers what’s called an eREIT.

REIT stands for Real Estate Investment Trust, and when you invest in a REIT you’re investing in property like apartments, malls, office buildings. That kind of thing.

Fundrise claims their eREIT is better than traditional REITs, but I had trouble separating marketing fluff from facts.

Secondly, PeerStreet allows you to loan money to people who need a loan for real estate.

They pay you monthly interest for a year, or whatever the term of the loan is, and at the end you get your principal back. Of course there’s always risk of default, but the property acts as collateral.

And that’s what’s called a “debt” deal. This is important to know, because when you’re doing debt deals you’ll receive a 1099-INT tax form, the same form you’d get earning interest from a savings account.

Lastly, RealtyShares offers both “debt” and “equity” deals.

With an “equity” deal you become a shareholder in the property along with other investors. RealtyShares handles this by creating an LLC for each property.

How do equity deals work? Say you’re part owner in a rental property. You get your share of rental income. Or say you’re lending to a developer who’s putting up a hotel. You get your share of any appreciation after the hotel is sold.

The thing with equity deals is you get a Schedule K-1 tax form, which means if the property is in a state other than where you live you’re required to file a tax return for that state too.

With all this in mind I decided PeerStreet was the easiest option:

- PeerStreet only offers debt deals, so no need to file additional state tax returns

- Their minimum investment is $1,000, less than the $5,000 minimum for RealtyShares

- Their peer-to-peer lending is more transparent than Fundrise’s eREIT

Creating an account with PeerStreet was simple: link your bank account, transfer cash, and start looking for investments.

After the initial novelty wears off you might just want to get your money invested, and so I used a feature called automated investing. You pick criteria and PeerStreet makes the investment. Here’s what I used:

- Interest rate of 9%+

- Loan-to-value up to 70%

- Loan term up to 12 months

Then I closed my laptop and flew to Nicaragua for a few weeks. While I was off grid PeerStreet found a property and invested $1,000. (You can cancel within 24 hours.)

This is the dream, right? Sitting on a tropical beach sipping a cold drink earning passive income.

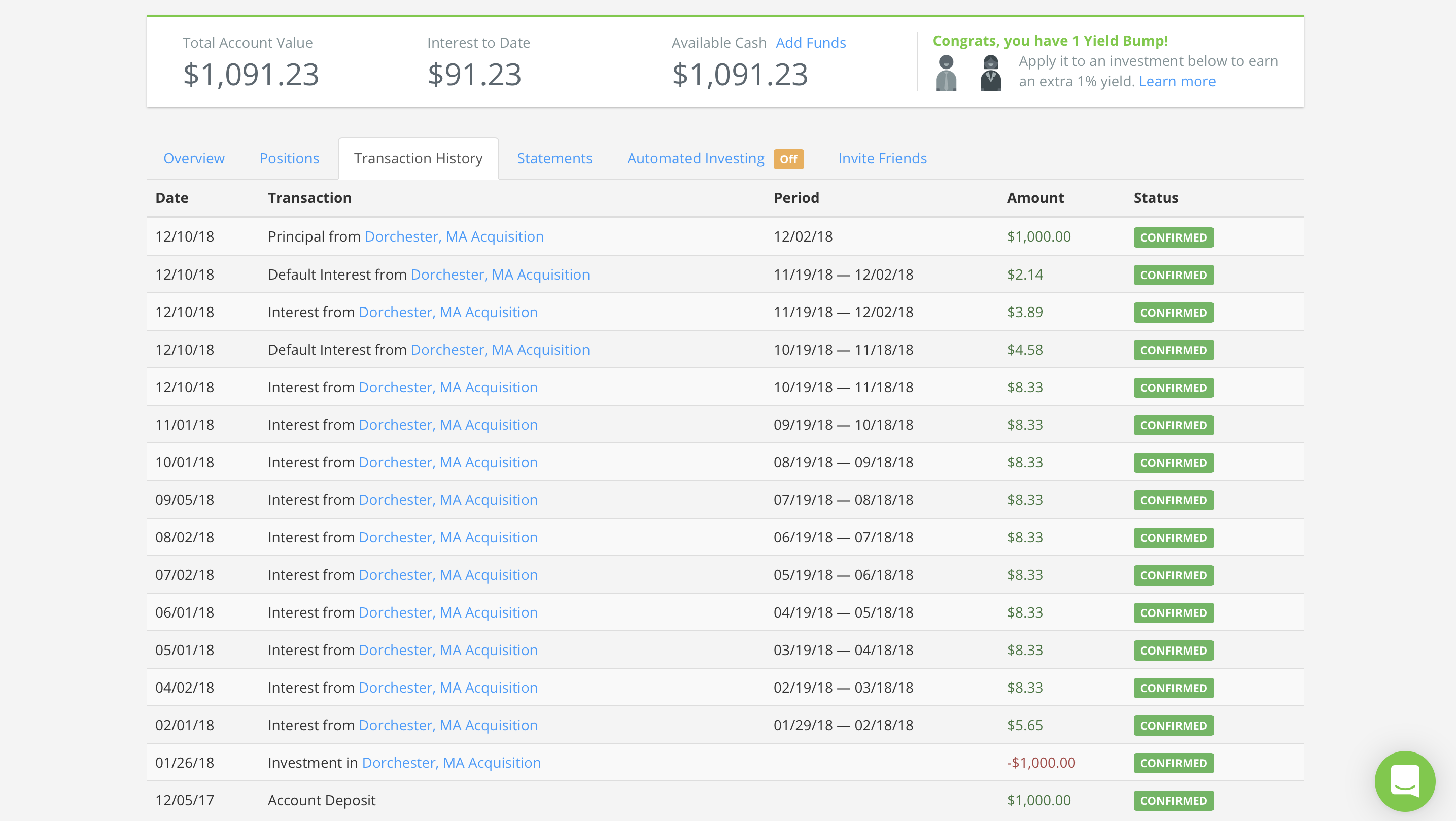

It turns out the $1,000 investment was a tiny sliver of a $650,000 loan to acquire a mixed-use property. The interest rate was 11% for eight months.

PeerStreet waived their 1% fee for this first investment, and so that meant I should earn $73. The math for that works like this: $1,000 times 11% is $110, $110 divided by 12 months is $9.17 per month, and $9.17 times 8 months is $73.

The loan started January 29th and was set to mature October 19th, but in reality didn’t get paid off until December 10th, about 10 months later. Total earnings were $91.

PeerStreet was a fun experiment, but I’m going to stick with stocks because I know enough to know that stocks are within my circle of competence.

But I also know some people are deathly afraid of the stock market. In fact, someone just wrote me, “I don’t play in the Wall Street casino where the house always wins.”

And that’s fine, because there’s no “right” way to invest, just like there’s no “best” investment.

You have to figure out what works best for you.

Note: PeerStreet isn’t paying me, and I’m not including a link that pays me a commission if you sign up for it. I’m just sharing what I’ve learned.