To Gain Money, Lose Money

When someone claims to have amazing long-term stock gains you know what else they have? Losses.

But investors hate losses!

Actually, it’s a common human trait. It’s been said the pain of loss is two times as powerful as the joy of gain.

In other words, a stock you bought that quickly rises 50% feels wonderful. You walk down the street with your chest puffed out. Your friends ask for investing tips. Your spouse thinks you’re brilliant.

But staring at a stock you bought that dropped 50%? Well, that feels terrible. Like you lost 100%. Everything.

Ironically, losing money is exactly how investors build long-term wealth. It’s required for gains.

I have no problem taking a 50% loss here and there. I experienced it during the financial crisis in 2008. I’ll experience it again.

Of course, I don’t like staring at a loss. In fact, I wish I never had one. But I accept them as part of building wealth. Why? Because the mindset that allows you to lose 50% is the same mindset that allows you to gain 500%. Most investors will never gain 500% on anything because they’d never invest in a way that they’d lose 50%.

They’re always selling.

After a stock goes down they sell. “I got out at breakeven.” And after a stock goes up they sell. “You can’t go broke taking a profit.”

Their adopted maxim is “don’t lose money,” but if you’re investing in great stocks, and expecting to hold onto them for many years, should the day-to-day or year-to-year price fluctuations even matter?

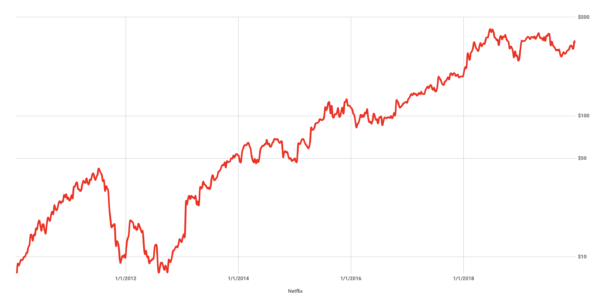

Here’s an admittedly cherry-picked example.

Netflix was one of the best-performing stocks from 2010 through 2019. It increased 4,224%, turning a $10,000 investment into a life-changing $432,444.

It’s easy to wish you bought Netflix in 2010, but would it have made a difference?

- In 2011 it dropped 79% from $42.68 to $8.95

- In 2012 it dropped 58% from $18.46 to $7.69

- In 2014 it dropped 35% from $69.20 to $45.21

- In 2015 it dropped 37% from $130.93 to $82.79

- In 2018 it dropped 44% from $418.97 to $233.88

The stock has been a nightmare to own. It suffered five separate drops of 35% or more. Dropped more than 58% twice. More than 79% once.

Most investors can’t stomach those losses. They would have sold.

But volatility is the nature of the stock market. Whether you’re investing in stocks like Netflix or broad-market index funds you’re going to spend time losing money. Some days it’s a small amount. Others it’s huge. But it’s how you react to losing money that ultimately determines your gains.

Maybe a simplistic way to think about all this is to start with a $100 portfolio split between two stocks.

The first stock goes up 50%. The second goes down 50%. You’re left with one stock that’s worth $75 and the other $25. They cancel each other out.

But investing has little to do with wiping out 50% losses with equal gains. It’s about building wealth.

So what if the first stock drops a stomach-churning 90% and the other skyrockets 140%? You’ll see this is okay. The losing stock becomes $5 and the winning stock $120. That’s a total of $125 on $100 invested. A 25% annualized return.

The same concept applies across multiple years.

Say your $100 portfolio went up 40% last year and then drops 10% this year. At the end of last year it was $140 but it’s down now to $126. If you’re like most investors you’ll be sitting there feeling terrible, thinking you lost 10%, and wanting to sell.

But in reality, you still gained 26%. So who cares?

I know it’s hard to look at investing this way, that to gain money requires losing it, but that’s how small fortunes get built.

This was originally posted on Forbes in March 2020. Re-posting it here for a permanent archive.