Making The Case For Higher Pay – Why 3% Raises Suck

The three things I write about, which will let us reach financial independence, are how we can spend less, save more, and invest. One of the easiest ways we can save more is so simple it’s brilliant: make more money and keep our spending flat.

The three step plan for this is so simple even Miley Cyrus could put it into action:

- Make the most money you can.

- Create a lifestyle where you spend the least amount of money possible.

- By nature of steps 1 and 2, you automatically increase the amount of money you save. Invest this.

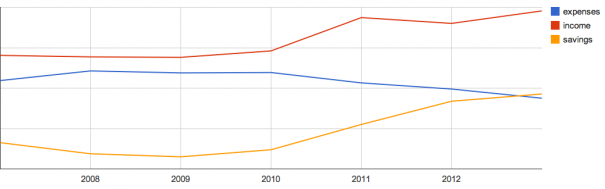

I put this plan into action in 2010 and I want to share the results of what will happen with my own chart of expenses, income, and savings. Take note of the difference before and after 2010:

We can see over the years as my income increases my savings increases. Meanwhile, the amount of money I spend has slowly decreased. At this point my expenses will flatline (Step 2) because I’ve ratcheted down my spending as far as I want to. Therefore, in the future my savings should mimic my income: if I make a dollar more, I’ll save a dollar more (Step 3).

I want to talk about Step 1 more, making the most money. First, pretend for a minute we’re graduating from college. For some readers that will soon be reality. We’re bright-eyed and bushy-tailed and ready to make the most of our degrees. We land our first real job and we’re excited because all that hard work in school has paid off with a salary of $50,000, roughly the starting salary for new graduates (across all degrees). Cool, we can afford all those good microbrews now!

We bust ass at our job, crank out excellent work but at our first yearly review we’re in for a rude awakening. What’s this? A $1,500 raise? You’re kidding me!

Typical merit raises over the last few years have hovered around the 3% mark. While that’s nothing to celebrate, it should meet and slightly exceed the inflation levels that make everyday goods and services from eggs to health care go up year after year. But we’re better than that. We’re performing. We should be compensated more for our work.

And I want to make sure that you are. Not only because you deserve it if you’re a top performer, but because of the huge difference it makes in your lifetime earnings. Your future self will thank you! Let’s check out three different scenarios and then a real life example.

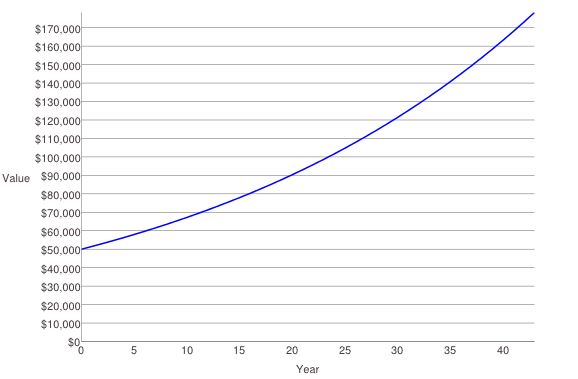

1. 3% yearly raises

We show up, go through the motions, and get a clockwork 3% raise every year for 43 years until we retire at 65.

Using the compound interest equation we can calculate the salary we’ll make when we’re 65, after 43 years: 50,000*((1+0.03)^43) = $178,226 salary at 65.

This adds up to a lifetime earnings of $4,452,420.

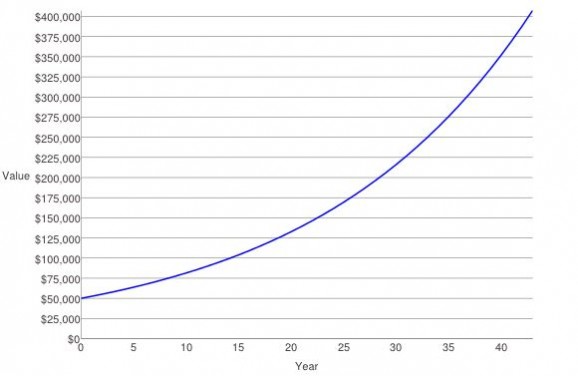

2. 5% yearly raises

We show up and put in extra effort, get a promotion here and there, and average a 5% raise every year until retirement. 50,000*((1+0.05)^43) = $407,483 salary at 65.

This adds up to a lifetime earnings of $7,557,150.

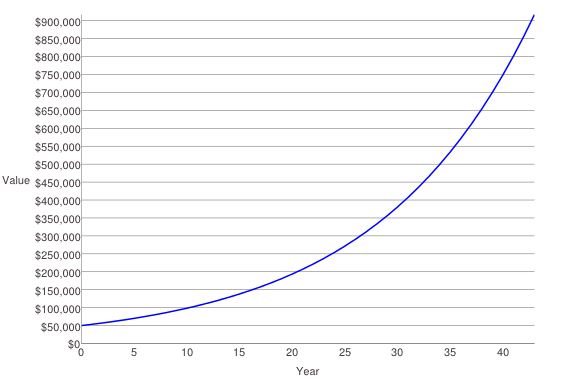

3. 7% yearly raises

We show up, do an awesome job, regularly receive promotions, change employers a few times for better opportunities and average a 7% raise every year until retirement. 50,000*((1+0.07)^43) = $917,218 salary at 65.

This adds up to a lifetime earnings of $13,306,043.

A real world example

The following is a real salary history; it is exactly the sort of salary increases we want to strive for.

- 2006 – starting salary of $39,000

- 2007 – a 7% raise to $42,000

- 2008 – a 19% raise to $50,000

- 2009 – time off for travel!

- 2010 – new job with a salary of $65,000, a 30% increase

- 2011 – a 30% raise to $85,000

- 2012 – new job with a salary of $100,000, a 17% increase

This guy, averaging 17% yearly raises over six years, is certainly not alone. There are tons of people doing the exact same thing and managing their biggest asset – their career – effectively.

Okay, so averaging 17% yearly raises isn’t sustainable for a long period of time. Even averaging 7% yearly raises over the course of a career isn’t sustainable for most of us. The point, however, is to make as much money as possible as fast as possible so that out of the gate we’re saving more. Eventually we’ll hit a ceiling and our raises will be in that 2%-3% range. That’s not a problem, but that point shouldn’t come for 15-20 years after we start our career.

If you want more information around career advice, especially if you will be graduating from college soon, check out Ramit Sethi’s blog I Will Teach You To Be Rich. While we’ll forever disagree on the value of being frugal, I think he offers good insights and effective tactics on things like negotiating salaries so you can get those big raises you deserve.