Being a Parent, a Financial Decision?

While most 20-somethings struggle to pay off student loans, establish an emergency fund, maybe start saving a down payment for a house, all while still finding a way to feed and clothe themselves, there might be a very large looming expense in the near future.

It’s an expense that also cries a lot and fills diapers.

While having a child will undoubtedly bring additional expenses to household finances, some may not realize how much it will affect their everyday dollars. On a yearly basis, the USDA comes out with a figure for the cost of raising a child through the age of 18.

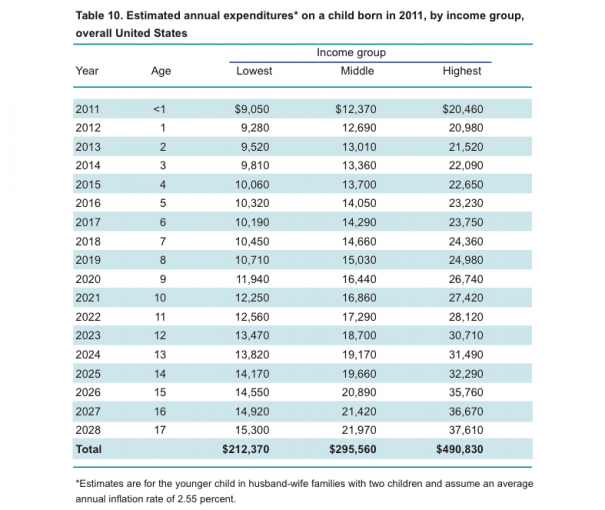

The last report available, from 2011, put that figure anywhere from $212,370 to a whopping $490,830! And that doesn’t even include the cost of college!

Granted, I always take these built-for-headlines dollar amounts with a grain of salt, so let’s explore this topic a little further.

Historically, having children, and a lot of them, was expected. My parents already had three kids by my age. And at 33, I’m still working on settling down with the right woman, pursuing my passions and interests, and spending time advancing my career.

We all know that people these days are waiting longer until they have kids, because of some of the same reasons I am. Additionally, with the availability of contraceptives, having children has become more of a lifestyle choice.

With that said, since I don’t have children, but someday would consider one or two, I wanted a better idea of how much financial impact they’ll have on our everyday dollars.

Starting with the USDA figures, I could certainly raise a kid for less than the $490,000, which is based on the highest income group. But what about the bottom end?

The $212,000 figure is based on the lowest income group, meaning before-tax income less than $59,410. Mr. Everyday Dollar can certainly do better than that too. Right?

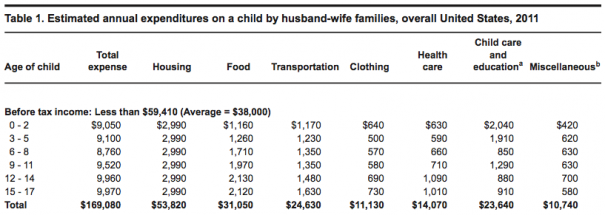

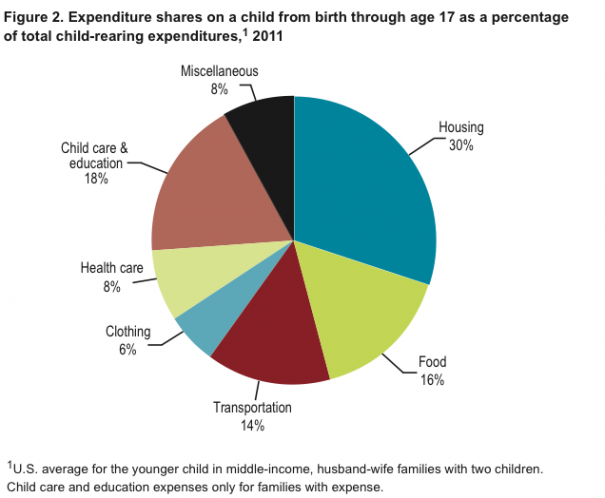

I decided to look further into the different categories the USDA uses to calculate the overall expenditure:

- Housing

- Food

- Transportation

- Clothing

- Healthcare

- Child Care and Education

- Miscellaneous Goods and Services

Here’s their breakdown by dollars, of those expenses (not inflation-adjusted):

1. Housing – $53,820

Consists of shelter (mortgage payments, property taxes, or rent; maintenance and repairs; and insurance), utilities (gas, electricity, fuel, cell/telephone, and water), and house furnishings and equipment (furniture, floor coverings, major appliances, and small appliances). Mortgage payments included principal and interest payments. Overall, principal payments constituted 15 percent of overall housing expenses.

I don’t think this cost would be any different today than it would be if I had children. I currently reside in a one bedroom condominium and would look to move to a comparably priced home, preferably around 1,250 square feet, with a couple more bedrooms. Therefore, we just cut $53,820!

2. Food – $31,050

Consists of food and nonalcoholic beverages purchased at grocery, convenience, and specialty stores, including purchases with Food Stamp Program (now the Supplemental Nutrition Assistance Program) benefits; dining at restaurants; and household expenditures on school meals.

You gotta feed kids, there’s no two ways about it. I learned that if you don’t feed the things you’re responsible for taking care of, they die. My pet fish when I was growing up can attest to that. I believe the data from the USDA is accurate.

3. Transportation – $24,630

Consists of the monthly payments on vehicle loans, downpayments, gasoline and motor oil, maintenance and repairs, insurance, and public transportation (including airline fares).

Similar to housing, I don’t think there would be much, if any, additional expense here. Granted, there will be extra trips to the doctor, the late night runs to pick up diapers, and the shuffling of kids to soccer practice.

I think that if we design our lives well, and position our family close to goods and services, we can eliminate the resulting increase in transportation costs of having children. The ultimate goal? Owning one car!

The families that really lose out on this category are the ones that move to the suburbs, resulting in the need to hop in a car anytime they need to go anywhere: doctors, dentists, haircuts, libraries, grocery stores, school functions, and daycare all require car trips.

And by not having the luxury of public transportation, they might even wind up with a car for every family member. We’re better than that!

Let’s cut the entire $24,630!

4. Clothing – $11,130

Consists of children’s apparel such as diapers, shirts, pants, dresses, and suits; footwear; and clothing services such as dry cleaning, alterations, and repair.

Much like food, you gotta clothe kids. And as much as I like the idea of potato sack outfits, I want my kid to be frugally fashionable. I think the $500-$700 per year is reasonable.

5. Healthcare – $14,070

Consists of medical and dental services not covered by insurance, prescription drugs and medical supplies not covered by insurance, and health insurance premiums not paid by an employer or other organization. Medical services include those related to physical and mental health.

As parents know well, trips to the doctor are a regular occurrence so we’ll keep this figure.

6. Child Care and Education – $23,540

Consists of day care tuition and supplies; baby-sitting; and elementary and high school tuition, books, fees, and supplies. Books, fees, and supplies may be for private or public schools.

While I believe that the figures provided by the USDA are a bit high, we’ll keep them.

7. Miscellaneous Goods and Services – $10,740

Consists of personal care items (haircuts, toothbrushes, etc.), entertainment (portable media players, sports equipment, televisions, computers, etc.), and reading materials (nonschool books, magazines, etc.).

This category is the one we have the best ability to control, like I talk about in posts like The 10 Things You Really Don’t Need. With that said, I’m going to half the USDA figure from $10,740 to $5,370.

Let’s talk about our totals then!

- Food $31,050

- Clothing $11,130

- Healthcare $14,070

- Child Care and Education $23,640

- Miscellaneous $5,370

This amounts to $85,260 to raise a child. I think it’s reasonable to assume, we as Mr. Everyday Dollars, could raise a child for well under six figures!

People choose to become parents for all kinds of reasons. My sister will say she never questioned it. To her, the decision to have children was as natural as breathing air. For others, it’s a drive to carry on the family name or to pass on genetics or family traditions. But one of the best decisions we can make for our financial bottom line may be not having children at all.

Your turn. Do you consider children a financial decision? How much do you think it costs to raise a child? Could you have done it for less? Please share your thoughts in the comment section below.