7 Lessons about Money and Life

This article really has nothing to do with money. But money and financial freedom are a byproduct. It’s not about success either, because everyone’s definition of success is different.

You could say it’s my manifesto, the guideposts that shape what I strive for. A way to live my best life right now.

It’s also what I turn to when I’m in my lowest moments, and nothing is going right.

At the risk of sounding preachy, I’m not saying that you should do any of these things. What I do think, and highly recommend, is writing down your own manifesto.

1. Money is meant to be used

When we walk into a restaurant we know that the server is trying to separate us from our money. The more we spend on food and drinks means a bigger tip for them.

I know that the most skilled server can size me up in five seconds by what I’m wearing, how I carry myself, and who I’m with. They know exactly what type of customer I am, and if they can upsell me.

Last Friday night I went to a high-end restaurant. I knew that I wasn’t going to order just an entree and a glass of water, so I asked the server to make recommendations and guide my choices. Nothing was off-limits because I was paying for the experience of fine dining for two hours, the money was a mere triviality.

Many financial experts say we need to cut everything, even the things that we deeply care about. As long as I’m reaching my financial goals then it’s okay to spend money guilt-free.

2. Minimize everything

Sitting in traffic while commuting to work is the unhappiest time of our lives, according to research presented in Thrive. A person who commutes an hour to work each day needs to get paid 40% more than a person who walks to work in order to achieve the same level of happiness.

We’re not as happy as our income would predict, so in a world of more, try less:

- Live in a small house close to work

- Keep the home free of clutter

- Travel lightly

- Simplify finances

- Maintain a streamlined wardrobe

In return for minimizing my life I get more mental energy, more money, more freedom, more time with friends, and more time to relax, which help me to have a life that’s filled with more happiness.

3. Ignore the herd

One reason Warren Buffett is a billionaire is because he’s fearful when others are greedy, and greedy when others are fearful. That’s what he advised us to do, too.

This contradicts just about every evolutionary instinct we have. If we break off from the herd then it’s easier for predators to pick us off. Staying with the group means we survive.

I’m financially successful, so people think that I should have the latest iPhone, drive a luxury late-model car, and live in a 5,000 square foot house that backs up to a golf course. I don’t do any of these things and that makes me stick out.

Everything I’ve done worthwhile in my life was a result of zigging when everyone else zagged, just like Buffett. It’s scarier, it’s uncomfortable, but it brings results. It’s how I became financially independent at 35.

I don’t have to do what everyone else is doing. In fact, sticking out isn’t such a bad choice.

4. Take care of myself

We all know that we should eat well, exercise, get 8 hours of sleep, and take vacations to recharge. But life tends to take ahold of us, and we don’t prioritize those things.

We can maintain long stretches of productivity and happiness when we prioritize self-care.

- Eat real food, not too much, mostly plants

- Exercise or practice yoga 2-3 times a week

- Say no

- Get 8 hours of sleep, and go to bed and get up at the same time every day

- Disconnect from technology with No Screen Sunday

And, maybe most importantly, laugh and have fun. I’m not good at that. Did you know that the average child laughs 300-500 times a day, the average adult 15 times? Laughter is good for us.

When I don’t take care of myself, I’ll inevitably find myself in a funk that I just can’t shake. This feeling can go on for weeks until one day when I snap back to normal. Maybe it’s depression, I don’t know. I should probably get that checked out.

5. Give back

Studies confirm that people who donate are happier, healthier, and have a higher level of life satisfaction. When we spend money on others, rather than ourselves, we immediately gain more happiness and fulfillment.

Are you a member of the lucky sperm club like me? Having been born in the U.S. I’ve been given a staggering advantage over many others in the world. For them, rising out of poverty is extraordinarily difficult. One of the main reasons is the lack of access to capital.

Kiva, a micro-loan program, is trying to solve that problem by allowing lenders to make loans to low-income entrepreneurs in over 70 countries. For example, I’m now helping a woman in Kenya buy chickens, and a guy in Columbia buy a cart so he can sell fish.

By being generous I promote social connection to humankind, so don’t be tighter than a gnat’s asshole.

6. Invest monthly, and then do nothing

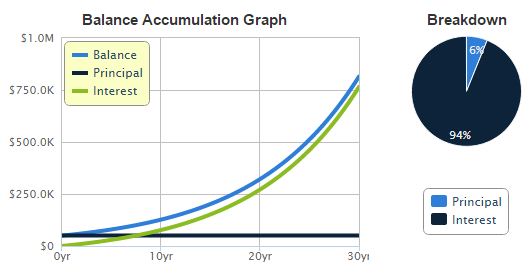

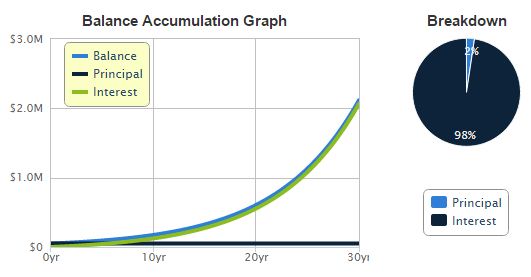

If we invest $50,000 in something that compounds for 30 years at 15% a year, and we pay 35% tax at the very end, then after taxes we keep 13.3%.

Instead, if we make the same investment, but we had to pay taxes every year of 35% out of the 15% that we earned, then our return would only be 9.75% per year compounded (15% – 35% x 15%).

The difference is 3.5%, and what 3.5% does over very long investing periods like 30 years is amazing. It’s the difference between not having a million dollars, and being a multi-millionaire:

So when we’re young we want 100% of our investable money – after we fund our tax-advantaged retirement accounts – in a simple stock index fund like VTSAX (as we get older we’ll want to add a bond index fund, and then slowly tilt towards bond for safety, a good hands-off choice is VASGX).

Then we practice patience.

Every month after I pay my bills and fund my 401(k). I take what’s left and invest it. I don’t fuck around with those investments because trading in and out means I’m paying taxes and buying yachts for Wall Street.

So if I want my own yacht, my own financial security, then I want the mathematical advantage of doing nothing.

7. Take action

We can read all the books we want, subscribe to all the life hacking blogs we want, and download all the productivity apps we want, but nothing will happen until we actually take action. 90% of success is just taking the first step.

Instead, I want you to do something, right now. Do something for your finances, your career, or your life that will move you one step forward, and help you to reach your goals.